Learn About The Potential For Monetary Advisors' Experience To Enhance Your Monetary Overview

Writer-Flynn Strauss

When it involves your retirement planning, the guidance of a financial advisor can be crucial in navigating the facility landscape of monetary decisions. From establishing possible economic goals to crafting tailored retired life strategies, their competence can make a significant effect on securing your economic future. Understanding the crucial role a financial expert plays fit your retirement plans can give clarity and direction in achieving your lasting financial objectives.

Conveniences of Dealing With a Monetary Consultant

When preparing for retirement, dealing with a monetary consultant can offer you with invaluable guidance and proficiency. A monetary advisor brings a wide range of understanding to the table, assisting you navigate the complex globe of retirement planning with ease. They can help you in setting reasonable monetary objectives, creating a personalized retirement plan, and making educated financial investment choices tailored to your requirements and take the chance of tolerance.

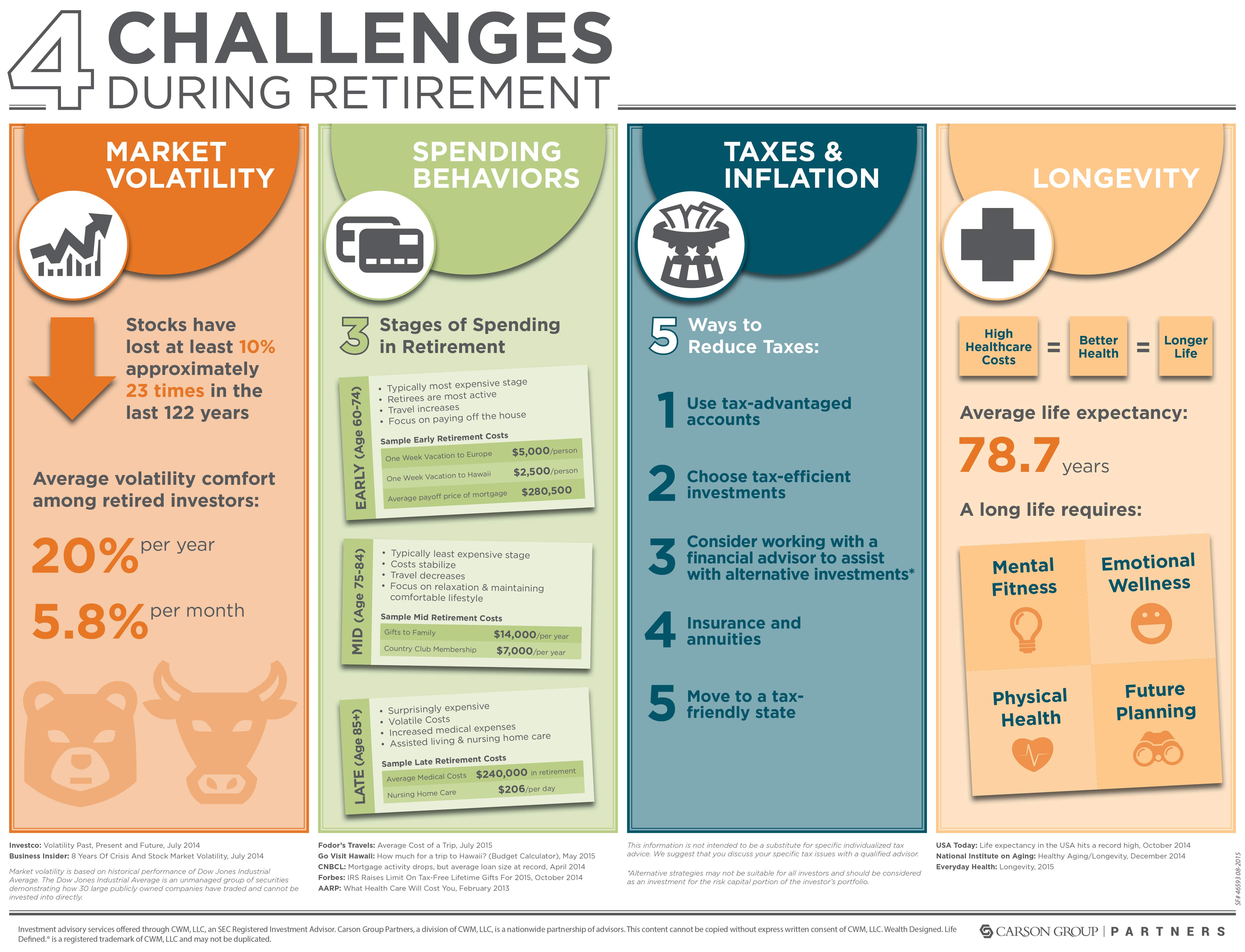

One of the essential benefits of working with an economic expert is their ability to help you optimize your retirement savings. By assessing your existing financial scenario and future needs, they can establish strategies to maximize your cost savings prospective and ensure a comfy retired life. Furthermore, economic experts remain current with the most recent market trends and financial investment opportunities, allowing you to make well-informed decisions that line up with your long-lasting goals.

Furthermore, an economic consultant can offer you with comfort by providing ongoing assistance and peace of mind throughout your retirement trip. They can aid you change your financial plan as needed, attend to any kind of concerns or unpredictabilities you may have, and inevitably equip you to make positive economic decisions that lead the way for a safe and fulfilling retirement.

Services Offered by Financial Advisors

Financial advisors offer a variety of services to aid you in managing your funds and preparing for retired life successfully. Wealth Accumulation can help you develop a customized financial strategy tailored to your specific goals and demands. They supply assistance on investment strategies, property appropriation, and threat administration to assist you construct a solid monetary structure for your retired life.

Additionally, economic consultants provide know-how in tax obligation planning, helping you enhance your tax circumstance and maximize your savings. They can likewise assist with estate planning, making certain that your possessions are dispersed according to your wishes. Retirement income planning is one more key service given by economic experts, aiding you establish just how to generate a stable earnings during your retirement years.

Furthermore, these specialists use recurring tracking and modifications to your monetary plan as needed, keeping you on track to satisfy your retired life objectives. By leveraging the solutions of a monetary consultant, you can gain assurance recognizing that your financial future is in capable hands.

Exactly how to Choose the Right Financial Expert

To locate the best financial advisor for your retirement planning needs, think about assessing their certifications and experience in the field. Try to find experts who hold relevant accreditations like Licensed Monetary Planner (CFP) or Chartered Financial Consultant (ChFC). Financial Managers suggest a specific degree of competence and commitment to maintaining sector standards.

In addition, evaluate the advisor's experience dealing with customers who remain in or near retirement. An expert who focuses on retired life planning will likely have a deeper understanding of the distinct difficulties and opportunities that feature this life phase.

When selecting a financial advisor, it's likewise essential to consider their fee structure. Some advisors charge a level cost, while others deal with a commission basis. Make certain you comprehend how your advisor obtains compensated to stay clear of any possible problems of interest.

Lastly, seek referrals from buddies or relative who've had favorable experiences with their own economic experts. Individual recommendations can supply useful understandings right into an advisor's communication design, reliability, and total effectiveness in aiding clients reach their retirement objectives.

Conclusion

To conclude, dealing with a monetary advisor is essential for effective retirement preparation. Their know-how and advice can aid you establish realistic economic goals, create individualized retirement plans, and make enlightened financial investment choices tailored to your requirements.

By choosing the right economic consultant, you can considerably improve your retirement readiness and financial health. Take the very first step in the direction of a safe and secure retirement by seeking the support of a trusted financial advisor today.